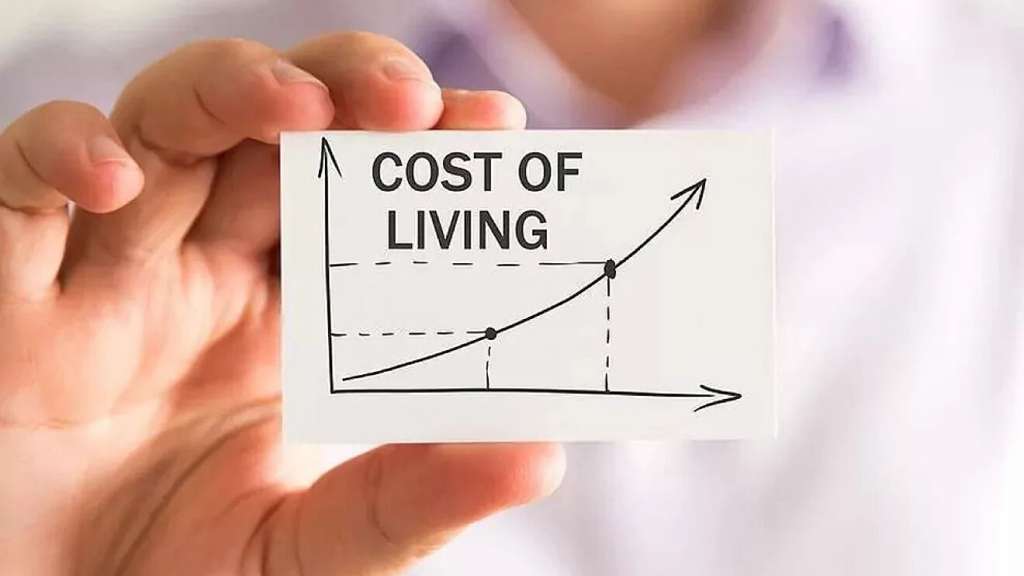

The cost of living hit a sparkling 30-year excessive ultimate month as energy, gas, and food prices endured to jump and stores reined in seasonal reductions.

Prices surged with the aid of using 5.5% in the 12 months to January, up from 5.4% in December, growing the squeeze on family budgets.

Inflation is now growing quicker than wages and is anticipated to climb above 7% this year.

The authorities stated it turned into a movement however Labour advised it to do greater.

Since pandemic regulations have been eased in the last year, agencies have confronted better wage, delivery, and power charges which they have got handed directly to customers.

Housing charges have additionally been growing, whilst the stores supplied fewer income and reductions in the New Year, as compared to the steeper reductions visible last January.

Clothing and shoes drove inflation up this month and even though there have been nonetheless the conventional charge drops, it turned into the smallest January fall because 1990, with less income than last year.

The cost of living is likewise growing, with pasta fees up 15%, cooking oil up 16% and margarine hovering at 37% in the year to January, squeezing family budgets.

Housing charges

Housing prices multiplied with the aid of 7.2% in the ultimate year and have been the most important contributor to developing inflation. This is because of charge rises for gas and strength following the 12% increase in the authorities’ cap on power fees.

Inflation prices for strength have been 19.2% for strength and 28.3% for gas in the year to February.

Rental fees have been additionally up 2.3% and prices for the ones dwelling on their very own domestic rose by 2.5%.

Fuel

Transport charges have seen an increase of 11.5% in the year to February – the most important increase of all classes measured by the Office for National Statistics and the alternative key contributor to developing inflation.

This turned into particularly because of skyrocketing petrol and diesel prices which hit file ranges ultimate month.

The common price of petrol turned into 147.6p in line with the liter in February, whilst diesel turned into 151.7p in line with the liter. These are set to continue contributing to inflation, with the charge of petrol now at £1.67 and diesel reaching £1.79 after sanctions have been imposed on Russian oil in reaction to the struggle in Ukraine.

It’s additionally really well worth bearing in thought that multiplied delivery charges have knock-on results at the charge of different merchandise and offerings.

The used automobile price grew because the pandemic endorsed human beings to search for options for public delivery that might preserve them secure from the virus. An international semiconductor scarcity has additionally affected the manufacturing of the latest vehicles and brought about greater second-hand vehicles being purchased.

Furniture, household equipment, and renovation

Prices for furniture, household equipment, and renovation rose with the aid of 9.2% in the last year. Furniture noticed the biggest charge hikes.

Clothing and shoes

Clothing and shoe fees have multiplied with the aid of using 8.9% because of “uncommon charge actions” at some stage in the pandemic. Prices last February have been decreasing than standard and fell after global entered its third lockdown and compelled non-crucial retail stores to close. But this year they are back to their everyday pattern, that is to upward push during January and February as new inventory enters stores after the brand new year income period.

This led to a bigger annual jump.

Food and non-alcoholic beverages

Food and non-alcoholic beverages fees have been up 5.1% in the last year and 0.9% from January, as compared to 0.3% from January to February last year. The increase from January to February this year turned into the biggest alternate at some stage in this time because 2012.

In the last month, the charges for bottled water, tender beverages, juices, meat, sugar, jam, syrups, chocolate, and goodies went up the most.

Restaurants and accommodations

Restaurant and motel payments grew with the aid of using 5.0%.

These increases must be interpreted with warning due to the fact many eating places and accommodations have been closed at some stage in lockdowns throughout the world and correct pricing statistics turned into now no longer available.

Recreation and way of life

The biggest contributor to growing inflation from January to February this year came from the charges of the way of life and undertaking, especially “video games, toys, and hobbies”.

They commonly fall in price between January and February, however this year they went up. In the last year, the cost of living and undertaking has grown by 4.7%.

Computer video games and greater conventional toys are getting greater luxury; however the price actions for the previous can now and then be huge relying on what video games are being released. Prices of DVDs rose this year rather than falling, whilst the carrying system – inclusive of golf balls and tennis racquets – and puppy meals performed a role.

Other categories

Prices for fitness and verbal exchange offerings have been at the bottom of all rises, at 2.6% and 1.1% respectively. Education charges went up with the aid of using 4.5%, whilst for heath prices, the figure turned into 2.6%.